Fundsup spoke with Bastiaan Reurink, founder of the innovative savings app Potje. Based on his own experiences and frustrations with group expenses, Bastiaan developed a platform that helps friends and family save together for various goals. In this interview, he shares the vision behind Potje, its unique revenue models, and the ambitious plans for the future.

A Dutch version of this article can be read on the website of our partner: Emerce.

How did you come up with the idea for Potje?

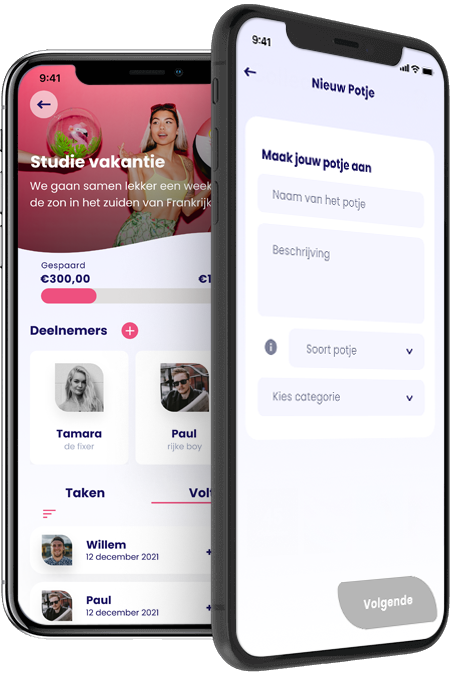

“The idea for Potje actually came from personal frustration. I used to go on trips with a group of friends, and we often agreed months in advance to save up. But there were always a few friends who didn’t have the money when it was time to book because they had spent it on something else. This made it difficult to make and follow through with plans as a group. I realized there was a gap between individual bank accounts and crowdfunding for group expenses. With Potje, I’m filling that gap by allowing people to save and manage funds as a group easily.”

What other situations do people use Potje for?

“Vacations are by far the most common use—think summer trips, ski vacations, or weekend getaways with friends or family. But there are also other uses, like collecting money for gifts, such as for a coworker, or saving together for a wedding. For example, families pool funds to help finance the event. There’s also the concept of penalty funds within sports teams, where members contribute a small amount if someone shows up late.”

Is the social aspect important in your app?

“Definitely! Potje makes saving visual and social. You can upload a photo of what you’re saving for and see who has already contributed. For certain savings goals, you can even hide the amount you’ve personally contributed if you prefer. The app also takes on the role of treasurer, even chasing up those who are late with their payments. This social element makes it more appealing to organize a group fund and encourages participants to contribute. People enjoy saving this way.”

How big is the Potje team right now?

“In addition to myself and my co-founder Ilya, who I met through the Y Combinator matching platform, we have two other developers and a marketer, along with a marketing intern. We’re a small but highly dedicated team working hard to grow the platform.”

How does Potje currently generate revenue?

“We have two revenue models. The first is direct B2C: each savings pot has a small fee depending on the amount saved. For instance, a pot up to €100 costs €2.50, up to €500 costs €5, and pots above that cost €10. Additionally, we have an inspiration marketplace within the app where commercial partners can offer relevant deals. For example, discounts from a travel provider or a product like Minibrew—a home beer brewing system. Potje users get exclusive discounts, which adds real value.”

Is there anything on the roadmap that you’re planning to launch soon?

“Absolutely. In addition to the savings function, we want to introduce a payment solution. Our goal is to allow users to pay directly from their savings pot with a Potje card in their Apple or Google Wallet. This would make group spending even more seamless.”

What milestones are you currently working toward?

“Our main focus is on user growth. We’ve been growing at an average rate of 15% per month and want to maintain this pace to eventually reach hundreds of thousands of users. Additionally, we’re working to onboard more partners. By Q1 2025, we aim to have at least 20 partners integrated into the app.”

What advice would you give to other entrepreneurs?

“I think the most important thing is to keep going and work step by step toward your goal, even when things get tough. I’ve found that persistence always pays off. It’s a long journey, but it’s incredibly rewarding.”

More information for investors about Potje can be found here.