Shelter-in-place and stay-at-home orders have impacted society at different levels. The economy is suffering. Some businesses have had to close their doors, and the future isn’t certain. How to invest during a financial crisis of such proportions?

Let’s have a look at the status quo. You’re probably used to investing in listed companies. But right now, the stock market is a poker game of sorts, and you’re firefighting. Since banks are risk-averse by nature, we shouldn’t count on them to save the world, either. Does that mean you’re left to your own devices? Well, kind of. But it’s not a bad thing. Because if you think about it, those devices represent everything you need to invest during a financial crisis and turn risk into opportunity: knowledge, expertise, and resources. If you use those elements to invest in startups whose businesses you truly understand, your investment won’t be random, and that so-called perceived risk will be drastically lower than you thought it to be.

Best investment strategy in a recession: where to start?

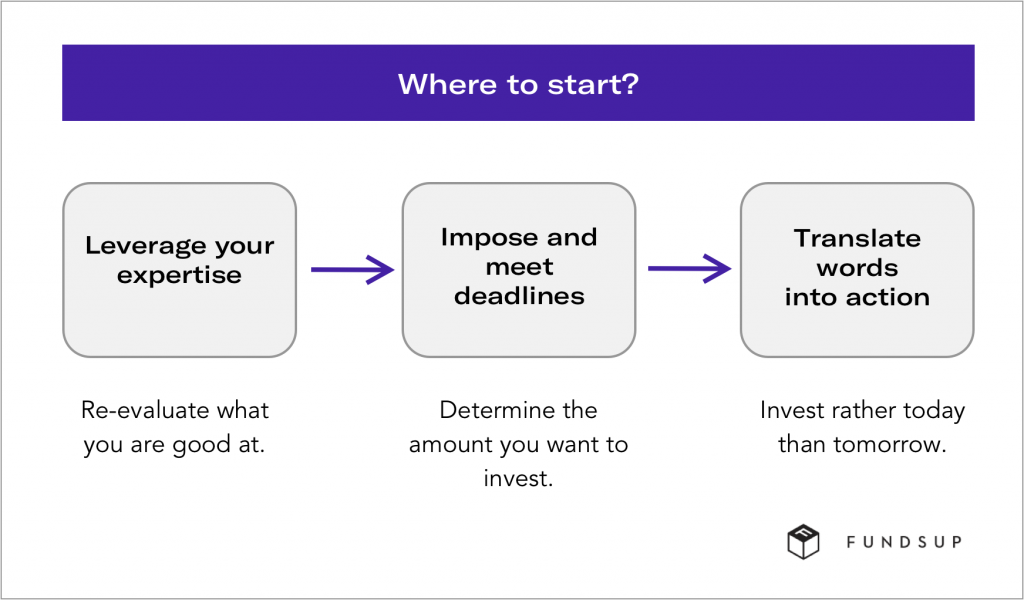

If you want to invest during a financial crisis, you should adopt a hands-on, well thought-out approach. This concise three-step plan can serve as your guide in trying times.

1. Leverage your expertise

What is your forte? Take a moment to re-evaluate what you’re really good at. Your investment strategy in a recession should always be aligned to your expertise, so you can guarantee a solid level of involvement. If you contribute your knowledge, your financial investment is much more likely to pay off.

2. Impose and meet deadlines

First, determine the amount you want to invest during a financial crisis like the one we’re going through right now. Then, set a deadline and meet it. Before you start looking for relevant startups, commit to investing within three months at the most. That will put you in the right mindset.

3. Translate words into action

The best investment strategy in a recession is to invest, rather today than tomorrow. Even if it’s just 50K. Make no mistake: the short term may seem concerning, but there are unmistakable opportunities in times of crisis that will pay off once the recession is over. All you need to do is spot and seize them – and that starts with you. So don’t dwell on your decision. Follow your instinct, find promising young talent within your niche, and get involved to realize brilliant business ideas.

What to invest in during a financial crisis and how to contribute?

Like we wrote above, the key is to be involved in the startups you invest in during a financial crisis. But what’s the right amount of involvement? Make sure you’re there when a founder needs you, but don’t overdo it. A biweekly or monthly call is usually a good idea. You’ll demonstrate your commitment, while founders will be able to realize their vision.

Ultimately, it’s all about chemistry: when like-minded people join forces, they’ll create something wonderful. It’s the people that count, not the product. Because human minds turn a product into a success – or not. That should be your basic principle when you’re looking to invest during a financial crisis: finding people whose niche, ideas, and expertise match yours.

Time to invest during a financial crisis?

Want to put your money where your mouth is and invest during this crisis? Discover hundreds of companies that match your purpose today.